Snowflake and Friends: 2020’s Tech IPO Wave

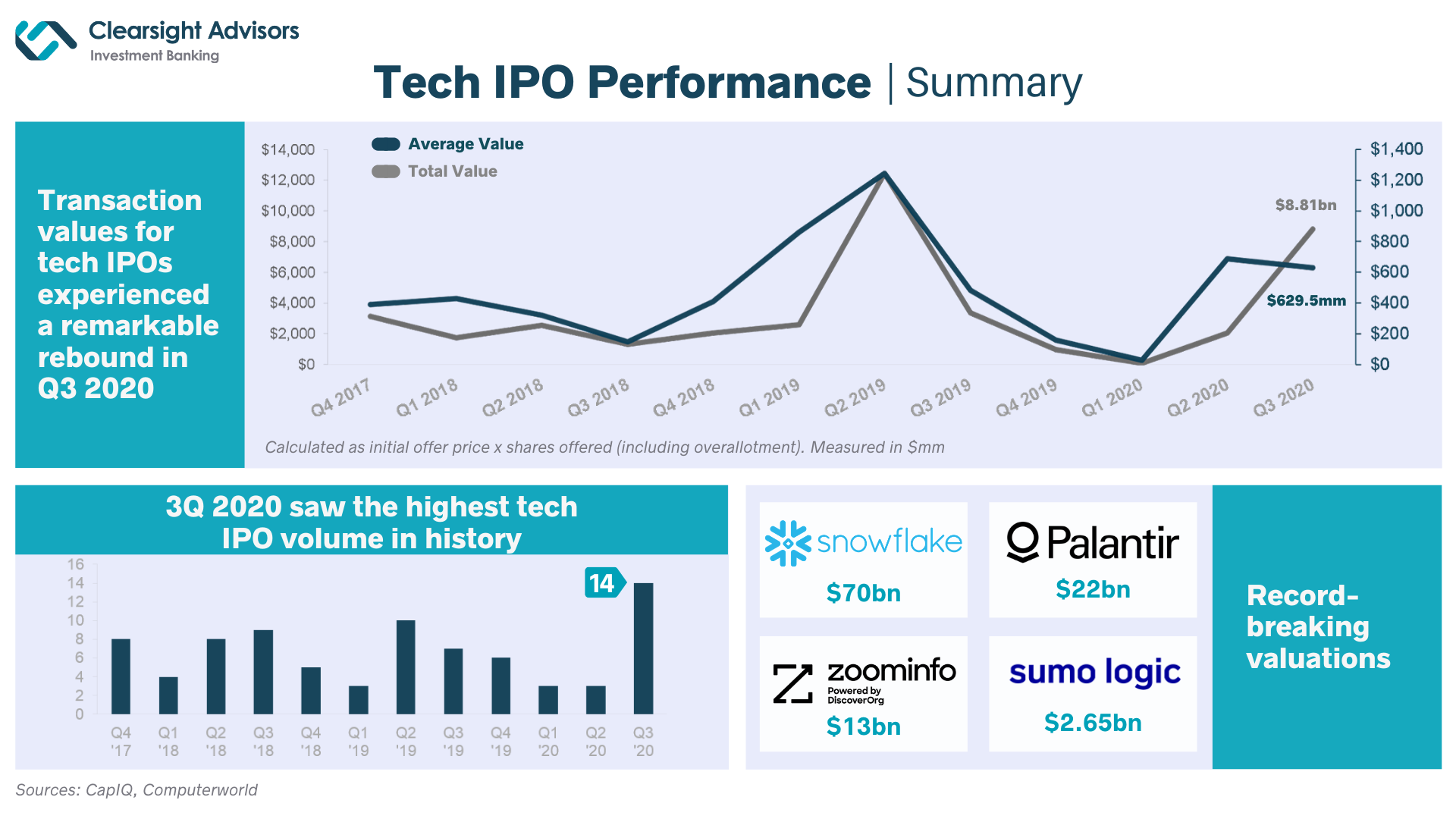

Despite the widespread economic implications of the COVID-19 crisis –including record unemployment and rising national debt— public markets are experiencing a remarkable bull market. In fact, the S&P 500 reached a record high of 3,386.78 in August after gaining more than 50% from its low in March. This rebound was especially relevant for the technology sector, which saw a 63% increase in share price in the same period and continues to outperform the market. With such favorable market conditions, technology and software companies are filing IPOs or issuing direct listings in record numbers. Q3 2020 was the most active quarter on record, with 14 completed technology and IT services IPOs and an aggregate transaction value of nearly $9 billion. The record-breaking valuations we’re seeing for technology companies entering the public market have implications for private technology and tech-enabled services businesses considering an M&A market entrance. We’ll examine the forces at play and the forecast for private valuations in the near term.

First, market interest in technology companies is highest for those seen as “next-generation” technology, often characterized by cloud-native applications and AI-driven data management uses. As we’ve discussed in previous blogs, enterprise customers and investors are increasingly motivated to invest in technology and IT services, especially those that efficiently make use of cloud technology, in order to enhance business agility amid unprecedented disruption caused by the COVID-19 pandemic. The result is the wave of high valuations for tech IPOs we saw in Q3 2020. Valued at $70 billion, Snowflake (NYSE: SNOW) was the largest tech IPO of the year and is widely seen as the next generation of data warehousing and analytics built for the cloud. Likewise, B2B enterprise software companies including ZoomInfo Technologies (NASDAQ: ZI), JFrog (NASDAQ: FROG), and Palantir (NYSE: PLTR) received multi-billion-dollar valuations on listing day.

The biggest driver behind the high valuations we’re seeing is the idea that the economy has quickly moved virtual (online retail, WFH, etc.). In the pandemic environment, B2C companies need to pivot in order to adapt to a profoundly changed standard of customer behavior that continues to evolve. Cloud fundamentally supports agility and elasticity in operations, particularly among distributed stakeholders. Because of this, businesses are rushing to all aspects of cloud-based technology to successfully adapt. For highly scalable software companies that meet this need, the growth potential in the short term is extraordinary, resulting in high valuations based on rapidly rising future expectations of revenue growth.

Since public markets often lead the private markets, we can expect high performers to similarly garner spectacular multiples in private deals. Based on public comparables, B2B firms enabling enterprises through next-generation capabilities are especially in-demand. For private software and tech-enabled services companies wondering what this may mean for their go-to-market strategy, it’s important to remain cognizant of how to best use this market interest to position your business for sale or capital raise. Strategic acquirers and PE firms are showing a strong interest in add-on and tuck-in deals that operate in the same markets as these next-generation technologies. At Clearsight, we work with the broad shadow market of services firms that are highly skilled in advising companies on how to enable these next-generation technologies. We are uniquely positioned to assist tech-enabled services and digital transformation firms that are looking to understand their position in the market and how to best capitalize on high interest in their businesses. Ultimately, growth potential is the most critical factor for companies looking at a major liquidity event, while public market performance considerations create the potential for strengthened valuation multiples.

Share