With ESG, No One Size Fits All

Business leaders are familiar with a fair number of acronyms: EBITDA, CAGR, BCM, CSR, GRC. Yet, one acronym is becoming increasingly important in the alphabet soup of a decision maker’s day-to-day: ESG. At its core, Environmental, Social and Governance is an evolving framework for stakeholders to assess, implement, measure and report how a company operates in its quest for profits. When integrated into a company’s strategy, ESG redefines how business is conducted to achieve long-term financial stability and value creation.

For decades, businesses have been laser focused on maximizing short-term profitability. This was accomplished in large part by managing by the numbers (MBTN). MBTN is a commonsense approach to understanding a company’s financial performance, whereby company leadership measures, monitors and oversees key performance indicators (KPIs) to achieve a desired result. Over the last decade, we have seen a not-so-subtle shift in the market whereby growth was sought after and rewarded handsomely, often at the expense of profitability. During this period, traditional business models were challenged (e.g. Uber and WeWork) and disruption was rewarded (e.g. cyrpto and autonomous vehicles), resulting in the modern-day unicorn. Today, the market is shifting yet again. Stakeholders and shareholders alike are expecting more from companies than ever before. It is no longer enough to simply drive growth or maximize profits. Maximizing value responsibly is becoming the requirement. That is where disciplines such as Corporate Social Responsibility (CSR), sustainability and ESG converge. Where CSR and sustainability are a means to responsible profits, ESG incorporates goals, metrics and insights on top of CSR policies. ESG is emerging as a powerful practice within risk management, and while still nascent, its impact, nuance and reach cannot be underestimated.

Through globalization, social media and virtual meetings, the world has become a much smaller place. Corporate brands and reputations are constantly and increasingly on display. Consequently, the sphere of reputational risk has expanded dramatically and become a top priority for investors, executives and boards worldwide. Companies can no longer afford to be reactive and correct issues as they arise. The market is demanding policies, proactive procedures and processes to assess a variety of risks and support sustainable business practices. Materially controversial ESG news has been shown to result in sustained negative financial performance. Conversely, investing in ESG initiatives has been shown to create long-term value. In a recent Mergermarket survey, 80% of asset managers and PE firms surveyed deemed ESG factors important to their investment strategy over the next two years. Indeed, ESG is inextricably linked to, and reinforced by the management of reputational risk.

Despite a growing body of methodologies, regulations and rating frameworks adopted by the market, there is no universal set of ESG standards to abide by at this time. In addition, those that do exist tend to be piecemeal in nature and partial in coverage. Even if a given industry or country does not yet have ESG standards, the desire for action on ESG is prevalent and largely driven by investors’ demands for transparency. Further complicating matters, the perceived importance and impact of each component of ESG can vary. The Sustainability Accounting Standards Board (SASB) is one such ESG guidance framework that is attempting to address this issue head on. The SASB has determined the materiality of 26 sustainability-related business issues across 77 industries to provide relevant metrics to cover the reporting of these risks. For example, mining and industrials are strictly governed by environmental guidelines, whereas human-capital intensive businesses may focus more on diversity objectives.

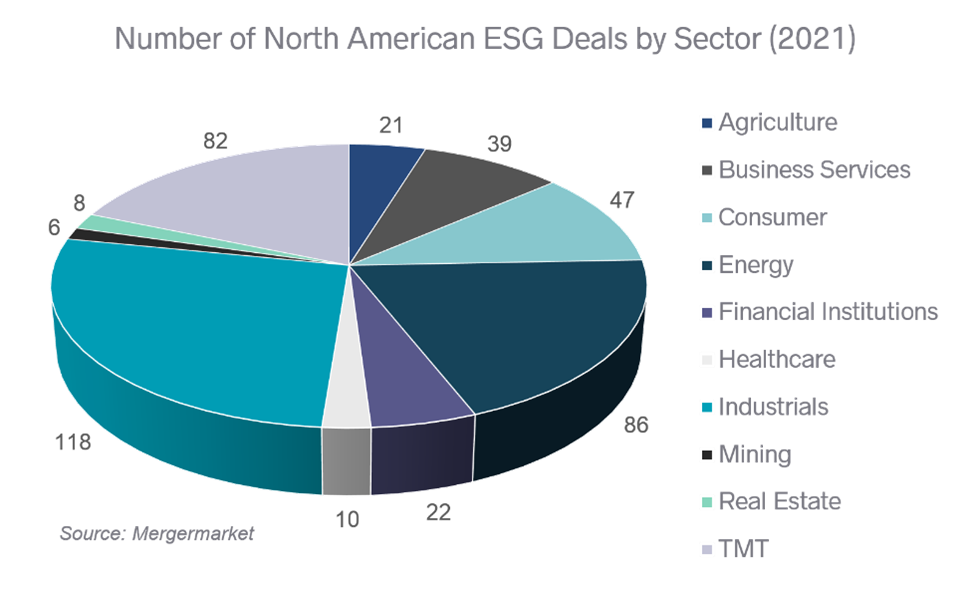

Across industries, ESG M&A activity remains pervasive. In January 2022 alone, Mergermarket tracked the announcement of 52 ESG or sustainability-related deals following a record of 75 deals in December 2021. In 2021, and continuing into 2022, the industrials, TMT and energy sectors lead the pack (see chart below). With 2022 YTD ESG deal activity already outpacing 2020, ESG is solidifying its place in M&A. Given its growing reach across industries, ESG cannot be viewed as a static, one-size-fits-all issue. Identical ESG implementations or strategies across businesses have the potential to yield vastly different results, leading to unforeseen risks and potentially negatively influencing stakeholders’ perceptions. As standards become more structured and adoption more universal, each company will need to invest time and resources to construct and apply its own flavor of ESG and risk mitigation.

While a culture of compliance is a solid foundation for ESG, it doesn’t support its evolving nature. Federal and state guidelines, viewpoints and reputational risks will evolve and require businesses to adapt their ESG policies and goals – those considered “good enough” now may not be in five years. Even as ESG and its associated services in data analytics in financial reporting matures, the value in ESG will still be found in subjective assessment. And while ESG initiatives can feel like hitting a moving target, they all begin with consistent and good due diligence, even if an exit is not on the horizon. ESG is an opportunity to create value, not just comply.

Meet the Author

Managing Director, Clearsight Advisors

jrakowski@clearsightadvisors.com

This publication has been prepared solely for the use of institutional investors for general information purposes. Opinions represent the author or individual referenced opinion as of the date of the report and is not to be construed as: a personalized recommendation; a solicitation or an offer to buy or sell any securities or related financial instruments; legal, tax, financial or accounting advice. Contents are based on information from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. Clearsight has no duty to update the information. The names and marks of other companies or their services or products may be the trademarks of their owners and are used only to identify such companies or their services or products and not to indicate endorsement or sponsorship of Clearsight of its services or products.

Share