Tug of War: Dueling Forces for Private Equity Create Unique M&A Landscape

As we approach the end of the year, we often engage in retrospection: considering actions we should or should not have taken, words left unsaid or those that spilled out, new fond memories or ones we’d rather forget. In the same sense, with the bulk of the year in the rearview and the dawn of a new one on the horizon, we’re unpacking the conflicting forces that emerged for middle market private equity (PE) this year and their potential impact on M&A in 2024.

While high-growth, founder-owned businesses had a productive 2023, PE was mired in the uncertainty of global events and macroeconomic conditions. Interest rate increases were a common theme in business considerations this year, and with good reason. For PE, significantly higher interest rates compared to the last few years increased the cost of capital, as both bank debt and direct lenders are largely dependent on the risk-free Fed rate. In turn, this decreases the valuation a PE firm can expect and/or offer during an M&A process. Private equity firms underwrite their new platform investments based on an entry multiple and exit multiple for any given portfolio company. For example, if a PE firm bought a company three years ago at 13x EBITDA, then they typically will underwrite and expect, at a minimum, to get a 13x EBITDA exit multiple when they look to monetize their platform investment. If the business has grown significantly during its investment period, the PE firm may be comfortable exiting at a lower multiple than entry, but it is situationally dependent. If a portfolio company has only grown modestly, it’s unlikely the PE firm will be comfortable exiting their investment when the macroeconomic environment and cost of capital have changed so dramatically from when they made their original investment. Generally, PE firms are looking to generate at least a 2x-3x cash-on-cash return from their platform investments, which can be a challenging achievement if an exit multiple ends up being significantly lower than an entry multiple.

Private equity isn’t just facing shifting macroeconomic conditions – the competition for premium businesses in middle market M&A continues to intensify. Platform-sized assets with $10-50MM of EBITDA in particular are scarce and therefore have the interest of many buyers. Paired with concern for overpaying for a platform asset, PE firms were oftentimes forced to the sidelines in 2023. Even if macroeconomic conditions remain fraught after the calendar turns, opposing factors will have a strong pull, bringing PE firms into middle market dealmaking.

The primary force driving PE back into dealmaking is obligations to their limited partners (LPs). The entire PE business model hinges on limited partners (e.g., endowments, pension funds, etc.). LPs invest money into PE funds, PE firms invest that capital into different businesses, and then return that capital (plus, hopefully, a profit) to LPs all within a previously agreed upon timeline. So, as much as PE might like to wait out the current economic uncertainty or shore up money for better days, they are largely subject to previously agreed upon timelines for capital deployment with their LPs. One metric PE firms use to gauge their investors’ returns is calculating a fund’s distributions to paid-in capital, or DPI. This ratio represents the real profits earned by the fund’s LPs. If a PE firm has been to slow to monetize their existing portfolio, it’s challenging for them to raise the next fund while their current fund is currently sitting at a low DPI metric (e.g., 20-30%). LPs would prefer to have more of their current investment monetized and additional capital returned before investing again.

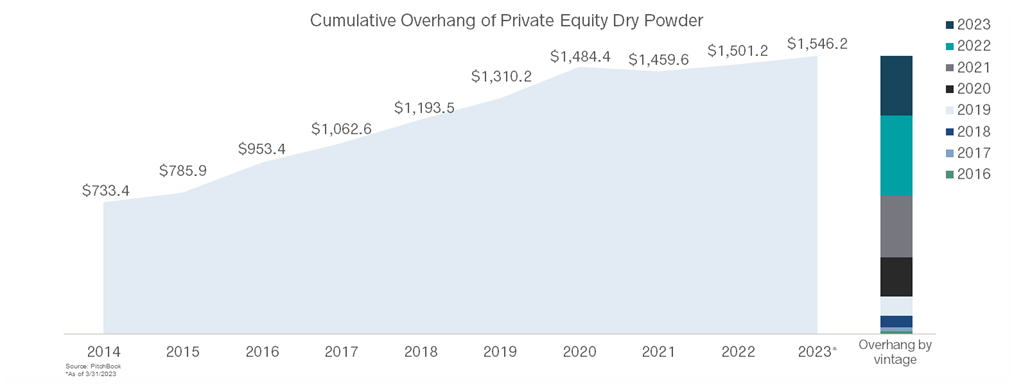

Private equity firms have amassed record amounts of dry powder recently, with 72% of total dry powder being raised from 1Q2021-1Q2023.

To combat the dueling forces of DPI and a tepid M&A market, PE firms are looking for a silver lining by accelerating timelines for the best assets in their portfolio. By exiting their prized assets sooner rather than later, PE firms are increasing their DPI metric by returning capital to their LPs. This reduces friction with LPs when raising their next fund. The remainder of their portfolio, which may not be performing as well, is then given more time to grow and optimize a positive return during potentially better macroeconomic times.

How quickly better macroeconomic conditions arrive remains to be seen, but regardless of the fiscal environment, PE firms will likely be more active in 2024. While there are certainly exceptions to this rule, the majority of PE firms in Clearsight’s network are structured to be on a schedule with their LPs and fund vehicles. As a result, they do not have the luxury of unlimited time. As we turn the corner into the new year, we anticipate PE firms to be more aggressive in deploying their dry powder as well as exiting existing investments to return capital and increase their DPI.

Contact Justin

Director, Clearsight Advisors

Washington, D.C.

jloeb@clearsightadvisors.com

Share