IB101: What is Investment Banking, Really?

Introduction to the Course

At Clearsight, we believe that great talent drives great outcomes. That’s why we’re launching IB 101, a new series penned by our team to help curious minds explore the fundamentals of investment banking, M&A, and the unique world of advising founder-led businesses.

Whether you’re a student exploring career paths, a recent graduate navigating your first professional role, or simply interested in the world of middle market M&A, this series offers a behind-the-scenes look at life at Clearsight. Through personal stories, practical guidance, and honest reflections, our team will share what they wish they knew before starting in IB, and what makes Clearsight’s approach so distinctive. IB101 is your front-row seat to the insights, lessons, and stories that shape our work — and our people.

Investment Banking- What is it?

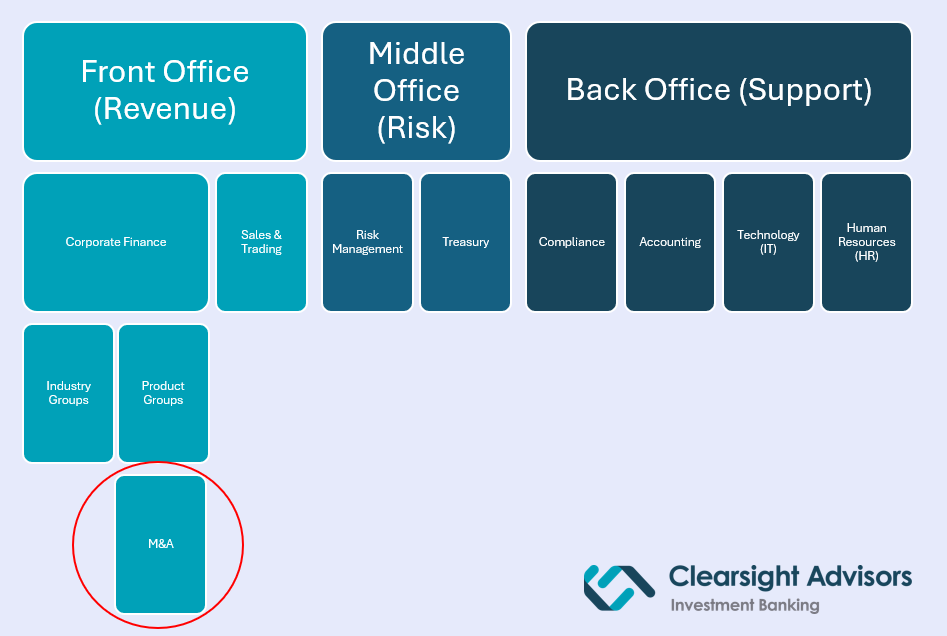

- Back- office roles: Think accounting, IT, human resources, compliance– the operational backbone.

- Middle- office roles: The folks who keep things running smoothly, such as risk management and treasury.

- Front-office roles: This is where investment banking lives. It includes corporate finance, sales & trading.

When people talk about “investment banking”, they are usually referring to front-office work. Within that bucket, there are two main paths. Sales & Trading is a significant and important branch of investment banking that facilitates the buying and selling of financial products and derivatives, while the corporate finance divisions help clients raise capital and navigate complex financial transactions. The latter bucket is further subdivided into “Industry” and “Product” groups. While Industry groups track a specific vertical, product groups are tied to very specific types of transactions, including Mergers & Acquisitions, Debt Capital Markets, Equity Capital Markets, Leveraged Finance, and Restructuring. For this series, we will specifically drill into M&A, a specialized IB product division that is the core focus at Clearsight Advisors.

M&A at a High Level

By refining our analysis of the broader banking industry, we can now address the core question we routinely receive: what really is M&A banking?

As M&A bankers we are, at our core, advisors. We provide financial and strategic expertise to facilitate complex Merger & Acquisition transactions and achieve successful outcomes for our clients. At Clearsight, we primarily represent sell-side clients – companies that are looking to either raise capital or pursue a change-of-control transaction – though we also have experience with buy-side engagements and corporate divestitures.

In a sell-side transaction, we work closely with the client to help align back-office data, build detailed forecast models, and position their company for a competitive process with a field of potential buyers in their sector. Clearsight’s network of “buyers” spans middle-market private equity investors and large strategic acquirers – many of whom we have deeply established relationships with. On the buy-side, we help explore the market for new acquisition opportunities and assess the target companies’ potential fit for our client.

We will spend ample time dissecting the work we do as a specialized M&A shop in the coming weeks, though we hope this preliminary primer helps you better pick apart this jargon-based world of finance.

Why Does it Matter?

So far in the first part of this series, we covered what banking broadly encompasses, where M&A sits within that world, and what role it plays. But… so what? Why does what we do matter?

M&A advisors represent clients at some of the most critical and exciting junctures of a company’s life cycle. It is through M&A that clients not only realize value but also open the door to new partnerships and pathways to maturation. At Clearsight, we represent many founder-owned businesses. It is through our work that our clients can transform their hard-earned businesses – which they tirelessly built from the ground up – into long-term financial security. This core tenant shines through Clearsight’s unique, high touch processes and resonates strongly with our clients in the Knowledge Economy, who frequently exhibit similar founding principles. Of course, we represent an increasingly broader array of clients (especially in the private equity community) as companies in the Knowledge Economy continue to mature, though that makes our work only more exciting.

Looking Ahead- On the Syllabus

Ready to dive deeper? We’re excited to continue this series in the coming weeks as we further explore more investment banking topics. You can expect:

- Benefits of Boutique: The difference and the perks of working in a boutique IB firm

- Technical deep-dives: Models, analyses, and the little things that drive decisions

- Lessons Learned: Honest reflections on what worked, what didn’t, and what we wish we’d known before starting out

At Clearsight, we know banking can feel like a maze of jargon, acronyms, and late nights. Our goal with IB 101 is to cut through the noise, share real stories, and show why we are passionate about this work.

While spreadsheets and financial models are important components to our business, what truly drives us is the opportunity to help visionary founders and growing companies write their next chapter. There’s nothing quite like being part of that story.

So, buckle up — the crash course is just beginning.

Share