IB101: The Little Things and Why They Matter

We’ve all seen the memes about the stereotypical Friday night in Investment Banking – references to the late-night “pls fix” emails to align logos on a pitch deck after the Managing Director had a last-minute comment on vFinal or_vActualFinal of the presentation materials. Let’s face it: when you’re buried in an Excel model or a PowerPoint slide and the clock strikes 1:00 AM, it’s easy to wonder if the details really matter. So, do they?

At Clearsight and across investment banking, they absolutely do.

Contextualizing The Importance of Quiet Craftsmanship

To understand why the specifics matter, let’s think of a similar, service-driven experience, like going out to dinner at a nice restaurant. What often defines a memorable experience isn’t just the food, it’s the quality of the service. From the moment you walk in, the personal touches matter:

- Does the server greet you warmly?

- Is your table set properly before you take a seat?

- Are your utensils streak-free and is your table nice and clean?

- Does your waiter guide you through the menu or leave you guessing?

- Do they take time to understand your preferences before recommending a dish?

These little details distinguish restaurants from one another. In investment banking, the same principle applies. As a trusted financial and strategic advisor, you are helping clients navigate an unprecedented and remarkable moment in their careers. These subtle elements can compound into a successful deal process for everyone involved.

What do “The Little Details” Look Like on the Job?

Landing The Prospect

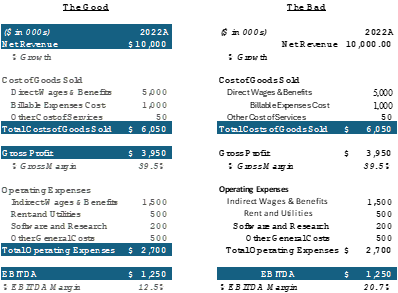

First impressions matter – banking is no exception. As a part of business development, investment banking advisors will typically “pitch” a prospective client with the goal to win their business. As expected, these pitches are high-stakes scenarios where every fine point matters. The presentation materials must be formatted to perfection; the bank must demonstrate the extensive effort they will make in representing the client should they agree to an engagement. Presentation materials should flow seamlessly, both in content and in visual design, to highlight a cohesive and appealing story for the prospect’s sale. Valuation models, such as Discounted Cash Flow (DCF) or Leveraged Buyout (LBO) models, must be meticulously crafted with emphasis on every detail, from number and color formatting to properly constructed formulae, so that the valuation estimates are realistic and attainable when put in front of a client. See an example in the picture below – who would you want to represent you?

When the Deal is Live

If the pitch is successful and the mandate is won, the refinement of every nuance only deepens as the client takes center stage. The bankers must focus on every aspect of the deal process to best position their client and share its compelling growth story with external parties. Detailed financial models must be built out with every single line item closely analyzed and growth expectations rationalized to ascertain buyer(s) confidence in the narrative. The client’s signature investment highlights are compiled in a visual presentation called a Confidential Information Presentation (CIP) where the narrative is meticulously fleshed out to entice relevant buyers with a promising opportunity.

From there, bankers must navigate the nuances of interpersonal relationships – with the client, potential buyers, lawyers, and other advisors and parties involved in a deal process. A banker must utilize their firm’s relationships to strategically communicate with and select a target group of buyers to put their client in front of the right people. Throughout the process, the banker must continue to be thoughtful of the granular aspects, such as making sure dinners are arranged in an accommodating restaurant for all attendees or having management presentations staffed with the buyer’s favorite snacks. All these fine points are tied together to ultimately differentiate a trusted advisor from a run-of-the-mill banker.

Why It Matters and How to Start

The little details add up to be more than just that – they ultimately become a key part of being a successful and trusted banker. Here at Clearsight, we pride ourselves in sweating the details in the pursuit of execution excellence. The careful design and formatting of a CIP or a financial model reflects the meticulous attention the banker provides a client and allows all deal parties to clearly understand what drives sustainable performance for the client. Likewise, the thoughtful planning of a management meeting or dinner between a client and a potential buyer can set the stage for a strategic partnership to blossom.

Many of these skills are learned on the job – but students can start developing an attention to detail now. When submitting a large project for class, take the extra time to ensure that the little details across the deliverable are perfectly strewn together. Schedule a call with an investment banker to learn more about their career path – take the time to be present and really listen to their experience. Follow up with a thank-you note afterwards that includes takeaways from the conversation to demonstrate thoughtfulness. Building these strong habits now will position you for a successful foray into investment banking.

At Clearsight, our commitment to the little things reflects the care, rigor, and respect we bring to every engagement. These details aren’t just cosmetic—they’re a reflection of how deeply we value our clients and their journeys.

Up next in the IB101 series: We’ll explore the unique advantages of working with a boutique investment bank—and why smaller can often mean smarter.

Share