Do Election Years Impact the Government Services Market?

A. Yes

B. No

C. It depends

As an advisor in the Government Services sector, we are inevitably asked by our clients whether elections impact the market. The answer is not binary. There are macro, industry-, and company-specific factors that influence investment decisions for both public investors as well as buyers and sellers in the M&A market. Examples include:

- Macro – How is the broad economy performing? Are credit markets supportive? Are there potential tax policy changes?

- Government Services Industry – What are the long-term strategic objectives and requirements within the federal budget? Where is the funding best aligned to support those strategies and requirements? Are there any agencies in or out of favor in the current or prospective political environment?

- Company – Does the company possess the capabilities and have the right access to customers with well-funded priorities? What is the company’s relative performance versus its peers? When selling, are there any pending contract awards or recompetes that affect timing? When buying, are there any capability gaps that need to be filled to better align with funding priorities? Are personal objectives or investment hold periods involved?

These are just a few examples, and we are barely scratching the surface of the various factors that influence market activity. Ultimately, the list is long, and yes, elections could be one of those considerations.

We analyzed market activity during the current and past couple election cycles to determine if we could observe any trends that could illustrate any notable effects on the market when comparing the election year versus the prior year.

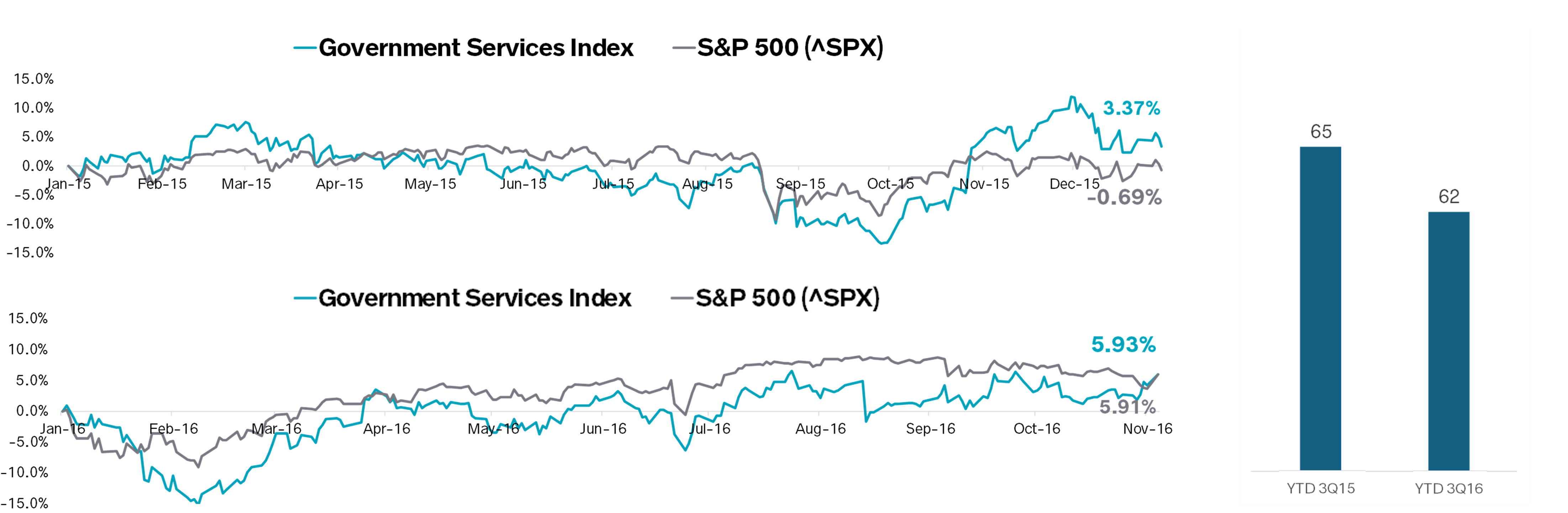

Relative Equity Returns and M&A Activity 2015 vs. 2016

The government services sector outperformed the broader market in both 2015 and leading up to the election in 2016. M&A activity was slightly down through Q3 ahead of the elections in 2016 versus the same period in 2015, but not at a notable level.

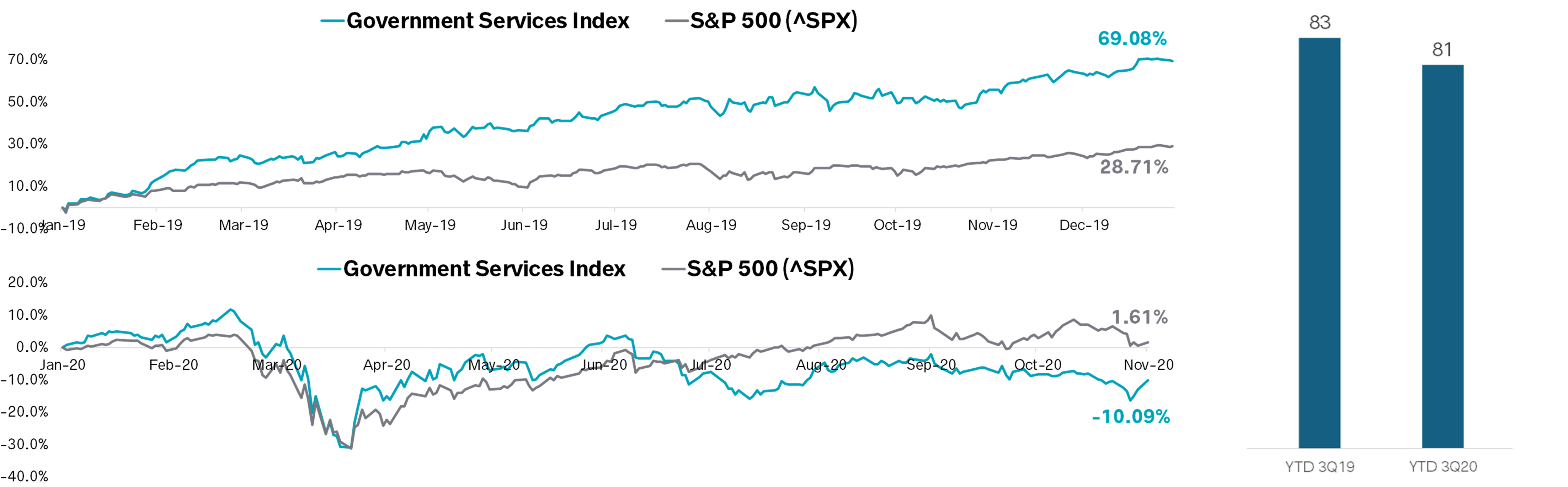

Relative Equity Returns and M&A Activity 2019 vs. 2020

Analysis of this period is complicated by the pandemic. The government services sector far outperformed the broader market in 2019, then lagged the broader market leading up to the election in 2020. However, during this period, there was also a substantial rotation into tech stocks at the cost of many other sectors. Again, M&A activity was slightly down through Q3 ahead of the elections in 2020 versus the same period in 2019. There was also a two- to three-month pause in activity in 2020 as people weighed the impact of the pandemic. Without that, activity was on track to outperform 2019.

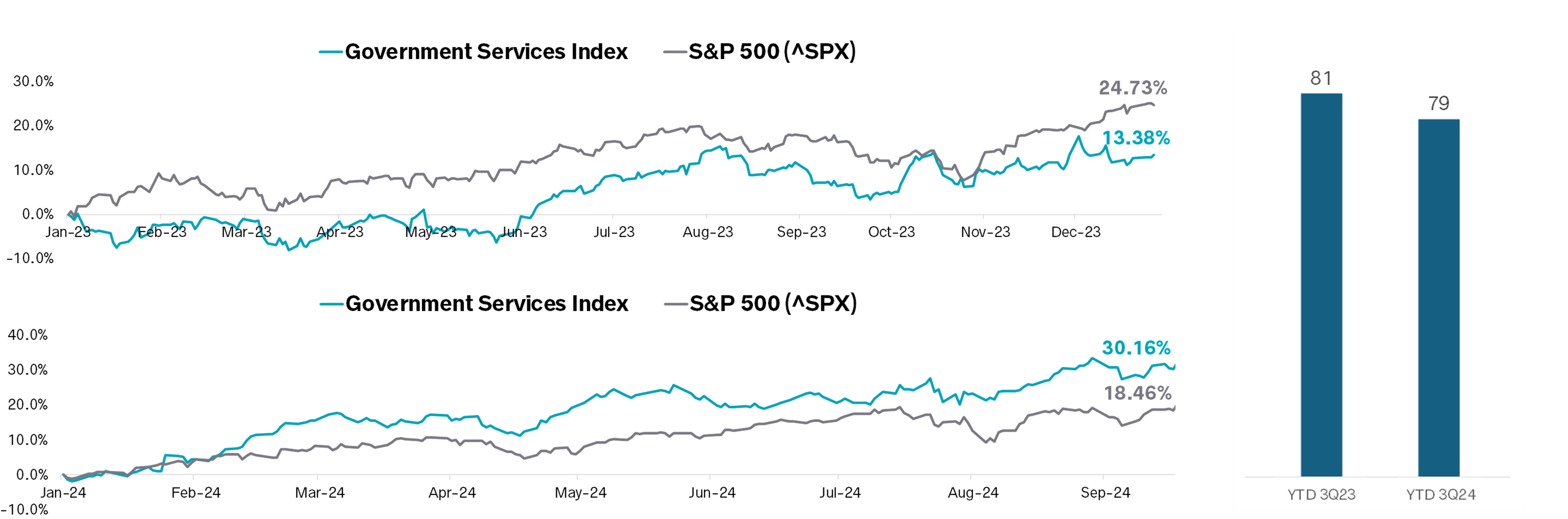

Relative Equity Returns and M&A Activity 2023 vs. 2024

The government services sector has strongly outperformed the broader market year-to-date after underperforming in 2023, despite still delivering attractive returns. Once again, the year-to-date M&A activity is slightly behind 2023. However, 2024 started slowly, and second half activity is providing a good opportunity to outperform 2023 by year-end.

So, do elections impact market activity? As shown, the government services sector can be up or down in an election year, relative to the broader market, and M&A activity can persist at healthy volumes. Anecdotally, a federal market segment could be in or out of favor of a prospective administration, and companies may have material exposure to those market segments. In these instances, an election will likely have an impact on decision-making and activity around these companies. It just depends.

Contact Matt

Matt Brom

Managing Director, Clearsight Advisors

Washington, DC

Government Services Index includes: BAH, CACI, ICFI, KBR, LDOS, PSN, SAIC, VVX

Sources: S&P Global, DACIS

Share